File an Extension With Our San Antonio Tax Experts

gst

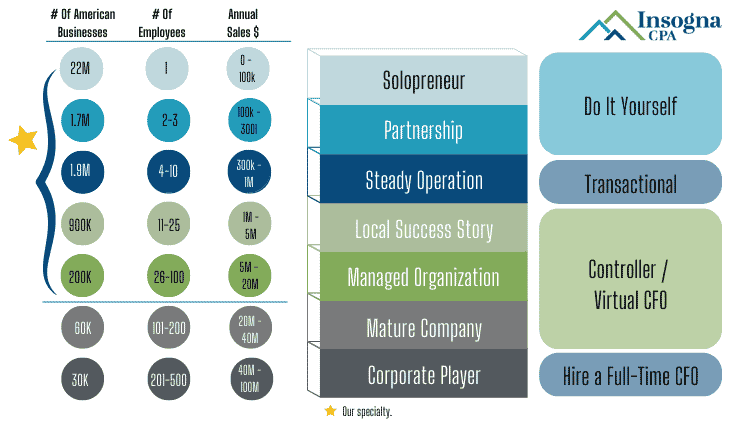

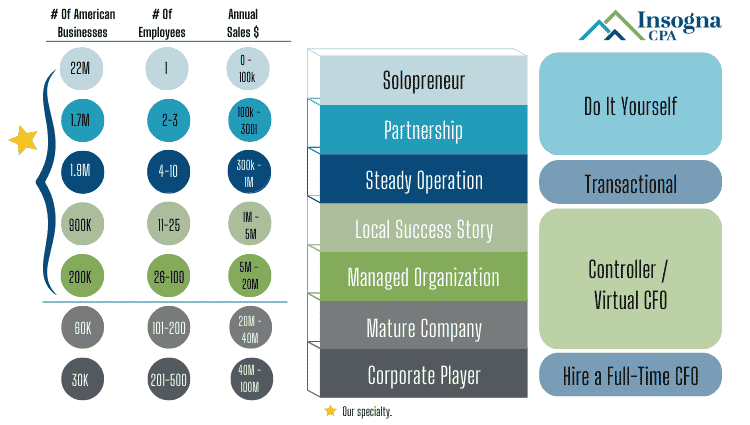

Our San Antonio team specializes in S-Corps tax preparation. You can either hire a professional to do your taxes, or you can file them yourself with expert assistance. Guaranteed. Tax preparers must help their clients comply with state and federal tax laws while minimizing their tax burden. You can get a free transcript if you forgot to print your return.

Individuals and businesses in Texas may be responsible to pay a number of taxes such as property taxes and franchise taxes. In certain disaster zones, taxpayers do not have to submit an electronic or paper extension. You should choose an accountant you can trust and with whom you have a good relationship. You can either hire a professional to do your taxes, or you can file them yourself with the help of an expert.

S-Corps are a special type of corporation which offers many advantages to small businesses. CPA firms can provide advice on tax planning and help businesses and individuals understand their tax obligations. We offer a variety of accounting services for individuals and businesses to complement our tax preparation service. They can defend taxpayers before the IRS.